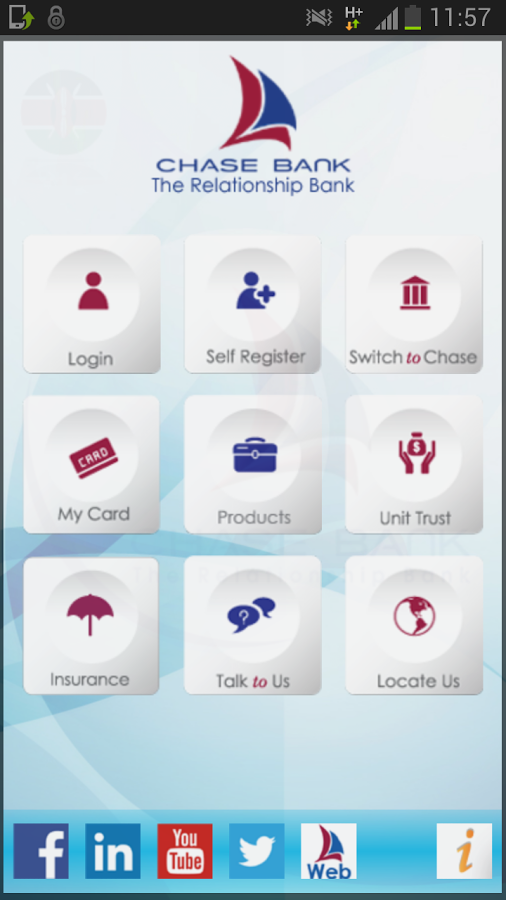

Chase Bank Kenya has today, (20th Feb 2014), launched Mfukoni, a mobile Android app that also runs as a USSD service. The app can be used to check their account balance and mini-statements, transfer funds to accounts within Chase Bank and to accounts in other banks, pay electricity and water bills, request for account statements, open investment accounts, pay taxes to the Kenya Revenue Authority, make requisitions for cheque books, allow for cheque deposits and stop cheque payments, make international money transfers, among other banking products and services securely using their phones.

Mfukoni, works on all internet-enabled phones as well as through USSD by dialing *275#, which then enables customers to log-in and access their accounts and perform banking transactions.

To start using the app, the customers should follow these 4 easy steps:

- Apply for the Self-menu on the Mobile App or dial the USSD code *275# on your mobile phone

- Upon Verification, your account will be linked to your mobile phone number

- You will receive login credentials on the mobile phone number you registered & on the email address you used while registering for the Chase bank account

- You will be prompted to change your PIN when you first log-in to the app

Mfukoni can also be accessed by customers who do not have account with Chase Bank by offering information about the bank’s offering, enabling them to apply and start enjoying services offered.

The uptake of mobile banking in Kenya is growing at a remarkable pace and it is increasingly becoming the platform of choice for delivering innovative financial services and commerce capabilities. This trend of continued reliance on mobile devices to execute monetary transactions is gaining momentum and reflects the right direction and preparation for the future of banking in Kenya and Africa at large. This mobile platform is available for download from various App stores including; Apple’s iTunes to support Apple products, Blackberry’s AppWorld, and Google’s PlayStore for all Android devices.

Customers using phones that are not data –enabled can access the service by dialing *275#, upon which they will follow simple steps to access and enjoy the bank’s services.

Through retail banking strategy, the Bank is keen to reach out to the percentage of the population that do not have bank accounts, particularly entrepreneurs who are ardent for financial inclusion. Chase Bank is keen to include digital strategy in their business model as part of its brand promise and commitment to deliver innovative products that meet its customers’ ever-changing needs.

“Chase Bank presents a significant step towards delivering universal access to financial services, through the introduction of Mfukoni. Our customers can now cease coming to our banking halls to queue to pay their utility bills, cheque deposit, tax payments, and open normal accounts among other banking transactions at the comfort of their homes, anywhere, anytime” said Paul Njaga, Chase Bank Deputy Chief Executive Officer.

According to Central Bank of Kenya recent FINACCESS Survey report 2013, the country’s financial inclusion levels are now at 80%, with mobile banking uptake contributing to 57% of the total number of Kenyans with access to some form of formal financial platform.

The proportion of the adult population using formal financial services rose to 66. 7 per cent in 2013 from 41.3 per cent in 2009. Recent CCK quarter four reports indicate that the level of mobile telephony penetration has increased by 2 percent to 30.5 million with an increase in mobile money transfer subscriptions from 23.2 million in the last quarter to 24.8 which translates to a 6.8 percent growth.