The Kenya government has been said to be a digital government, with the president and his deputy promising to digitize operations in the country during his campaigns that led to his election into office. The duo leaders have earned the digital name with their selfies taking rounds on the internet.

According to recent reports, president Kagame of Rwanda has been referred as the digital president in Africa with the highest number of followers on Twitter, followed by Kenya’s Uhuru Kenyatta and later Tanzania’s Jakaya Kikwete. Why I mention this is because, the three countries have been battling to achieve digital inclusion with new solutions for citizens in their respective countries.

Kenya however, prides itself ahead of the two East African countries when it comes to technology adoption and the opportunities available for growth having been named among the top three African countries adopting latest technologies at a fast rate, alongside other hubs such as South Africa and Nigeria.

Other countries in the continent are also working to try and achieve digital inclusion, with continued introduction of technology hubs and new solutions that aim to help make easy and effective the services from the governments and the private sector as well to better improve the lives of citizens and grow the country’s economy.

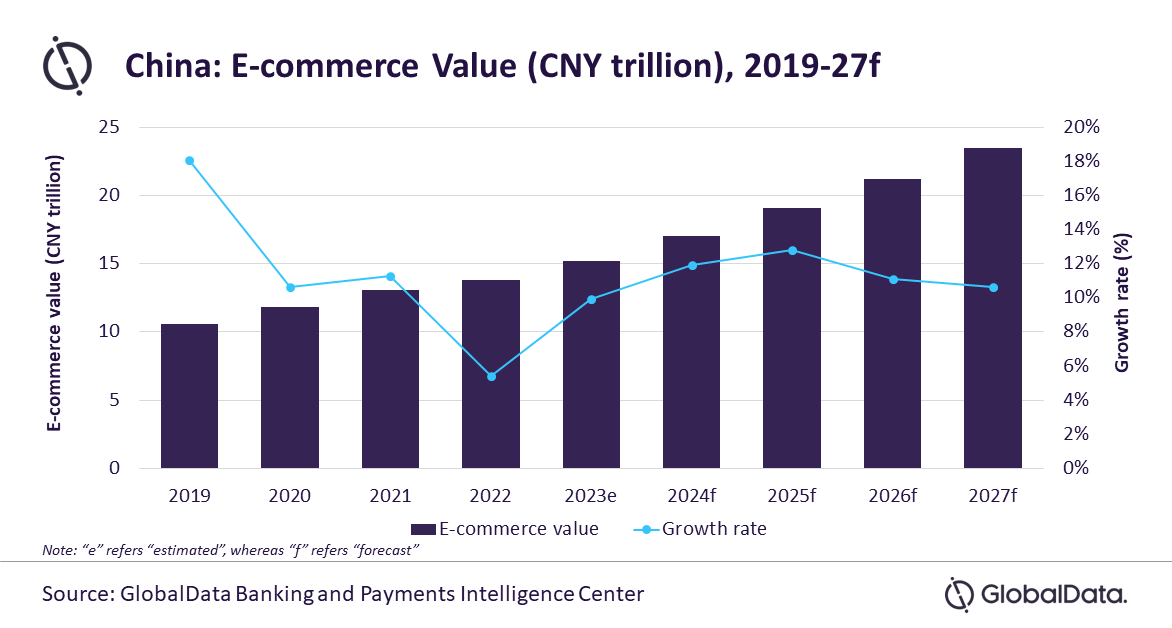

A recent survey put Kenya as the top African country when it comes to digital payments due to the popular and successful mobile money transfer platform by Safaricom, M-Pesa, that has seen growth in the country’s economy and has positively improved the lives of many citizens in Kenya.

When it comes to digitizing solutions, the country is investing largely in ICT startups in a move to identify new products and services that will be used to achieve financial and digital inclusion for all and new solutions are being introduced in various sectors contributing to development including banking, health, education and the key sector that is ICT.

Safaricom recently launched a venture fund to help nurture startups as well as partner with them to help improve effectiveness of operations, MasterCard and Visa have joined in the hope to transform cash transactions by promoting digital payments and other digital payment cards are being introduced for the public transport sector.

All these facts may put Kenya on a pedestal, but all this somewhat progress is not without disappointments for a country with a digital government and a digital presidency (as acclaimed) in this digital era we are living in and the digital revolution that countries and organisations are pioneering.

The digital migration highway from analogue broadcasting to digital broadcasting for Kenya, for example, has been a long and slippery road full of potholes, with never-ending litigations and set backs from the government itself who had a hard time agreeing on policies, Why? because everyone has their own vested interest that they seek to meet.

Recently there have been some progress on the same, with the migration timetable being announced for various regions across the country and a committee being put up to review frequencies. Kenyans can only hope that with the frequency reviews, the country does not face other setbacks from another law suit.

Just like the digital migration process, which took the government years and the pressure of meeting the deadline to finally reach on agreements for the dates, the transformation to a cashless fare system seems to be headed in the same direction and is using the same slippery road as the digital TV migration process did.

Why The Cashless Fare System is Duped For Setbacks

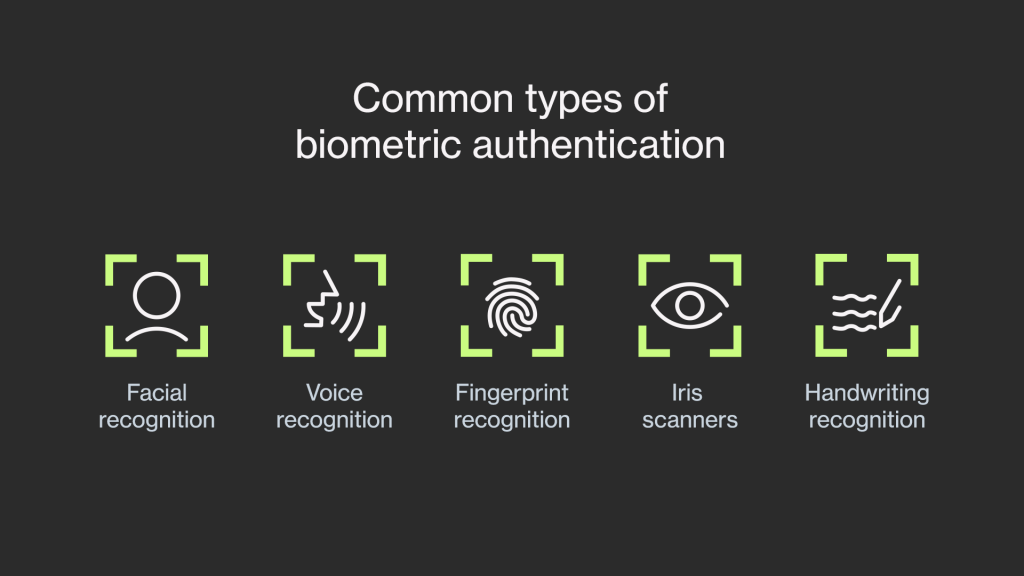

Kenya’s president launched the My1963 cashless card some time back, a card that was introduced in partnership with the government and the matatu owners association, in a move to eliminate the use of cash in public matatus for transportation in the country.

Apart from the My1963 card, other digital payments cards are also available to aid commuters by giving them options from which to choose from in the digital payments transition, including but not limited to the and BebaPay Card by Equity and Google and KCB’s Abiria Card.

Other options for the Cashless Fare system are through mobile money platforms such as through the Lipa na M-Pesa service, MobiKash- a mobile service that requires one to have a MobiKash account and it operates in the same way as the M-Pesa platform.

With these options being already available and waiting for Kenyans, both commuters and matatu operators, to take up the new digital systems, only few people are subscribed to a payment plan and even with those subscribed, almost none are able to use their cashless cards.

Not only are there few subscribed, but very few people are aware that lack of being subscribed to a digital payment plan will not only invite a fine for the matatu operators but also for the commuter. Yes- the commuter will also be subjected to a fine for using cash to pay fare.

Now, I have previously been subscribed to the BebaPay card made available for users in various matatus by Equity Bank and Google. I either lost it somewhere or I just cannot find where it is. A friend tells me that her BebaPay card is dusting in some corner somewhere in her house.

Some may look at this as being ignorant, I want to clarify that it is not in any way ignorant. It is as a result of the inconsistency of the platform availability across the transport matatus. When I owned the BebaPay card, I would use it in City Hoppa buses for transportation to and from Karen. Sometimes it worked out just fine, but not until you walk into a different city hoppa that is not using the system.

The conducter clearly lets you know they are not using the system at the moment, and you have to try and fish out some cash in your pockets, and if you are lucky then good for you, if not so lucky, the conductor will not hesitate to lash out insults at you for wanting to use a cashless system that is publicised in large fonts on the body of the bus.

The above scenario potrays an association of matatu owners(City Hoppa) that did not even believe in the service they were offering their customers, a situation that led them back to the paper receipts that ironically are provided for in electronic form in many buses today.

Earlier this year in June, Kenya Bus Services (KBS) in partnership with the Kenya Commercial Bank launched a cashless system that would see the use of the Abiria Card for its customers. This move was in line with the requirement by the government for all public transportation to go cashless, with a deadline given for 1st July, 2014.

Like a custom for Kenya, the country has a problem fulfilling promises and meeting deadlines (the digital migration saga) so the deadline was faced by set backs with policy issues and court cases, but after a couple of months these cases were however settled and a new deadline was set.

After the Abiria Card was launched, it is ironic now that the KBS buses do not have the card in use (at least the ones I have boarded). Instead, they have actually invested in electronic receipting where they give the customer an electronic receipt after paying for fare in cash. I recently asked a KBS conducter if they have the card system in use and he said, “Hizo bado, tunangoja Uhuru aamue” (not yet, still waiting for Uhuru to decide).

So why launch a cashless card if you do not plan to use it? Why vouch for a card that you do not believe in? It is clear that the card was introduced in light of the earlier deadline and may resurrect with another official launch when the current deadline nears. And Kenya can continue with the on and off relationship with matatus until the deadline is finally reached.

Matatu operators do not believe in the cashless system and this new move may be headed for failure if not worse consequences. Come the end of December this year, all public matatus are expected to have transitioned to the permanent cashless system, that is if the ongoing court case by a commuter does not have the date changed.

As Kenyans are limping forward towards digital inclusion for all, there is a lot that needs to be done to rebuild the potholes on the slippery road towards achieving the cashless fare system as well as convince Kenyans that the digital road is smooth enough to benefit everyone.